How Sparkling Water Flavors Were Prioritized in the U.K. and France

Before launching a new product in an international market, it can be critical to learn what varieties are likely to be most successful there—especially when it comes to qualities, like flavors, that can be highly influenced by region and culture. That’s why Good For All, a healthy food and beverage brand, looked to GutCheck to help them in the launch of their sparkling water line in Europe.

The Research

After a few successful years of growth of their sparkling water line in the U.S., Good For All is looking to expand their sparkling water operations to Europe. Two key markets have been identified for 2018: U.K. and France. To ensure that they are gaining traction for their products at launch, Good for All would like to run a Line Optimizer™ study to identify which flavors should be offered in each market to maximize reach.

Good For All hopes that at least 80% of each market would be reached with the flavors upon launch. And ideally, at least two flavors will be consistent across both markets, but offering unique flavors per market to meet market preferences is necessary. The following objectives guided the research in order to determine what combination of flavors would maximize the reach for Good For All’s new sparkling water line:

- Through tradeoff analysis, prioritize combinations of flavors based on purchase intent.

- Understand the relative strength of each flavor based on the following diagnostic measures: frequency, uniqueness, familiarity.

The Results

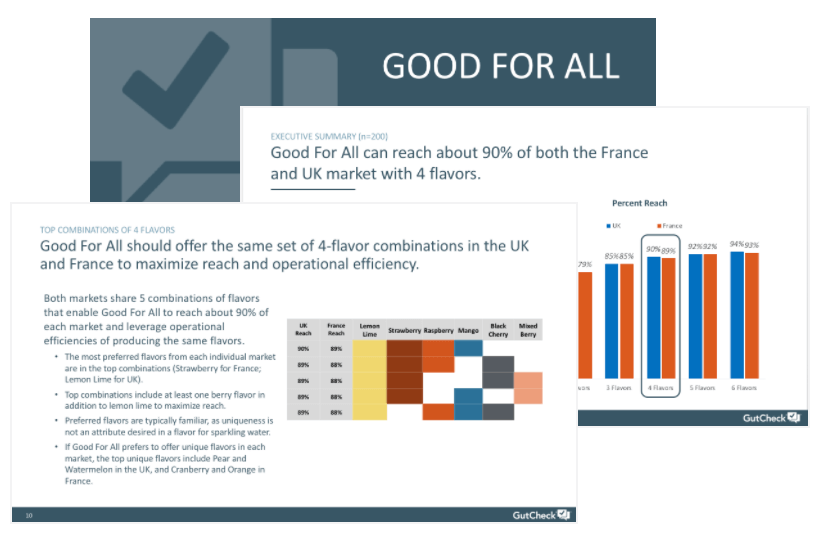

Good For All can reach about 90% of the market in the U.K. and France with 4 flavors.

A variety of berry-specific flavors, in addition to a citrus flavor, made up the top combinations of sparkling water flavors. The results also proved that Good For All could reach 80% of their market with only 3 flavors if they were looking to reduce overall costs and gain efficiencies.

Respondents in both the U.K. and France had distinct preferences in flavors that could provide the opportunity for Good For All to launch tailored flavor combinations in each market.

Pear and watermelon were seen as unique in the U.K., while France found cranberry and orange to be more unique. Additionally, U.K. respondents significantly disliked a pure or unflavored sparkling water. Respondents in France were less opposed to an unflavored option and more opposed to the watermelon flavor.

To learn more about our Line Optimizer™ methodology and international reporting for TURF analysis, download the full report. You’ll also learn

- How the findings helped Good For All prioritize the different combinations of flavors based on purchase intent for both the U.K. and France

- What 5 specific flavor combinations could be launched in both countries

- Which flavors performed highest across frequency, uniqueness, and familiarity in each market

Learn how GutCheck’s Persona Connector solution leverages a combination of survey and big data to bring actionability to persona development.

Follow us on

Check Out Our Most Recent Blog Posts

When Vocation and Avocation Collide

At GutCheck, we have four brand pillars upon which we build our business. One of those is to 'lead...

Reflections on Season 1 of Gutsiest Brands

Understanding people is at the heart of market research. Sure, companies want to know what ideas...

Permission to Evolve with Miguel Garcia Castillo

(highlights from Episode #22 of the Gutsiest Brands podcast) Check out the latest lessons from our...

1-877-990-8111

[email protected]

© 2023 GutCheck is a registered trademark of Brainyak, Inc. All rights reserved.

© 2020 GutCheck is a registered trademark of Brainyak, Inc. All rights reserved.