How Well Do We Know Our Customers’ Unmet Needs?

In a world where three-fourths of all consumers say they would be willing to choose, recommend, or pay more for a brand that provides a personalized service or experience (Forester 2015, Epsilon 2018), it’s imperative for brands to know their customers. Billions of dollars are being spent by marketers to personalize products, services, and communications for their customers and prospects.

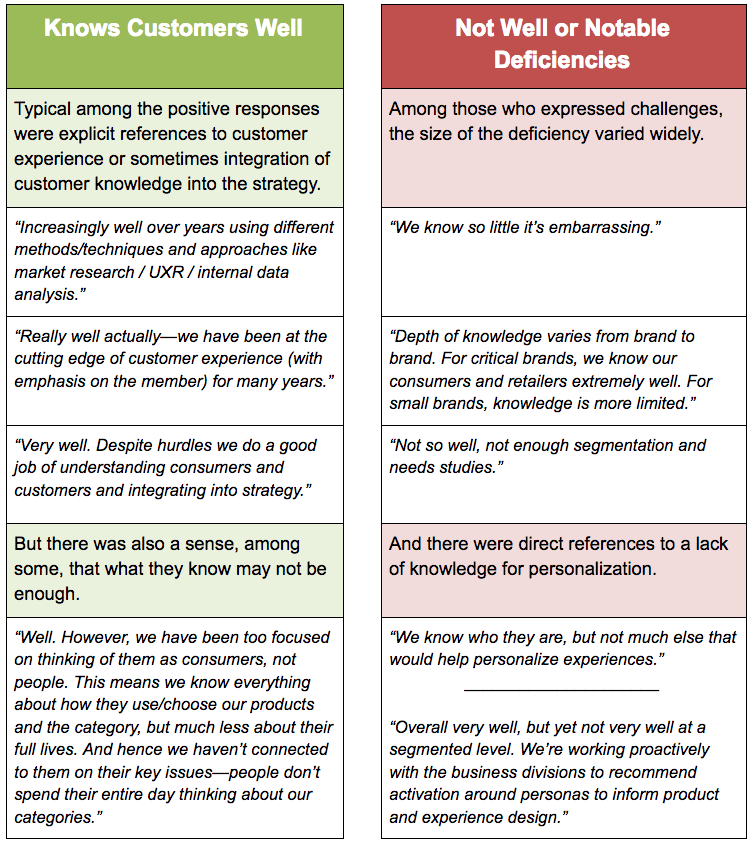

Yet, in this year’s Quirk’s Q-Report, when asked “How well does your organization know its customers?” almost half of all market research buyers indicated deficiencies or substantial gaps in organizational knowledge of their customers.

When asked about the biggest barrier to improving their customer knowledge, 47% selected a “lack of resources (money, time, personnel) for doing so” followed by “other” at 15% and “lack of provable ROI for doing so” at 11%.

In short, about half of all market research buyers say they need more information about their customers and about half say they face constraints from lack of time, money, and staff to obtain it. Did we, as market research providers, know that about our customers? And if we knew, or now that we know, what are we doing about it?

One way suppliers can help market research buyers get more granular customer knowledge is to avoid testing concepts and ads only among the general population or broad category users. Testing directly with a more targeted audience or using a targeted augment sample can help our market research buyers obtain insights relevant to personalization before they develop or launch a new product or service.

A second way we can help our market research clients know more about their customers is to arm them with insights about key subsets of consumers that we identify in-the-moment as we conduct other research for them. If while conducting a concept test we find that 40% of respondents are top-box favorable to a concept, we have identified an additional segment of consumers that we can profile on attitudes and behaviors. And if we move beyond survey-only profiling to include non-survey data, we can do this in a very agile way. Profiles of these in-the-moment audiences can feed into the creative brief or can be used to develop personalized offers, messaging, or product features.

A third option for helping market research buyers obtain customer information relevant to personalization is to think differently about segmentation and needs studies. Traditional segmentation, need-state, or demand space studies remain expensive—often $100K or more—and time consuming—typically taking 6–12 weeks. Sometimes these traditional studies are necessary and useful. But it’s likely time to rethink these studies to evaluate whether applying automation and/or combining big data with survey data, and/or applying agile market research principles can shorten turnaround times and provide more cost-effective options for today’s market research buyers.

Currently, hundreds of millions, and perhaps billions, of dollars are being spent on systems and analytics to support in-market testing and optimization of personalized offers and messaging after a new product or line extension launches. But if we more systematically gather and feedforward customer and prospect information relevant to personalization, then identifying optimal combinations of product features, claims, packaging, and ads for different types of customers can begin prior to launch, making post-launch optimization efforts more efficient. For example, if we know prior to launch that the dominant personality trait of top-box concept favorables is conscientiousness, that knowledge can be provided to the marketing team and used to tailor messaging so that fewer in-market iterations are needed before the optimal set of messages is found.

In short, we need to think of every pre-market study as an opportunity to gather more information on personalization (e.g., concept favorable audiences, high ad engagement audiences, segment and persona audiences, etc.). We also need to revamp how we help our market research buyers obtain strategic insights about consumers by applying agile market research principles and combining survey and non-survey data for greater depth at less time and cost.

The biggest barrier market research buyers cite to obtaining more customer knowledge—a lack of time, money, and personnel—is the same barrier that market research buyers were raising with us 7–10 years ago. And that buyer pain point led to the rise of agile market research approaches. We applied agile principles then and clients received insights faster and at a lower cost. Today’s market research buyers still have an unmet need. Let’s talk with them to learn more about their needs and identify agile ways to help them gain more customer knowledge so we can support their personalization strategies even before market entry or a product launch.

To see an example of how the GutCheck team helped Endangered Species Chocolate better understand their audience segments to inform marketing and activation strategies, while increasing the team’s efficiencies by using agile methods, take a look at the case study below.

Written By

Learn how GutCheck’s Persona Connector solution leverages a combination of survey and big data to bring actionability to persona development.

Follow us on

Check Out Our Most Recent Blog Posts

When Vocation and Avocation Collide

At GutCheck, we have four brand pillars upon which we build our business. One of those is to 'lead...

Reflections on Season 1 of Gutsiest Brands

Understanding people is at the heart of market research. Sure, companies want to know what ideas...

Permission to Evolve with Miguel Garcia Castillo

(highlights from Episode #22 of the Gutsiest Brands podcast) Check out the latest lessons from our...

1-877-990-8111

[email protected]

© 2023 GutCheck is a registered trademark of Brainyak, Inc. All rights reserved.

© 2020 GutCheck is a registered trademark of Brainyak, Inc. All rights reserved.