The Importance of Measuring Cannibalization to Achieve Product Innovation Success

If you follow our posts regularly, you know we talk a lot about what it takes to achieve product success and, within that, how critical the role of research is throughout product development. Today, we will focus more on a specific component of successful product launches: conducting research to measure cannibalization.

What is market or product cannibalization?

There are actually a few ways to look at and define cannibalization. Cannibalization can be described as the process by which a new product gains sales by diverting them from an existing product. It can refer to the extent to which one product’s customers are at the expense of other products offered by the same firm. And it can be the reduction in sales volume, sales revenue, or market share of one product as a result of the introduction of a new product by the same producer.

Both cannibalization and conquesting (more on this topic a bit later) are two important contributors to the success of a newly launched product. Product innovation success is highly dependent on measuring these two factors as early as possible in order to manage these natural market dynamics. For example, let’s say a peanut butter company wants to launch a new nut butter and they only currently sell regular peanut butter. The company needs to understand what percentage of their new nut butter’s sales will come from their current regular peanut butter buyers. That percentage represents cannibalization of their current portfolio. Any sales coming from consumers who don’t currently purchase their regular peanut butter would be considered conquest, or incrementality.

In order for a product to be successful, conquest must outpace cannibalization. And cannibalization can occur within a brand, a category, across categories, or a combination of these depending on the parent company’s product offerings. A well-known example of cannibalization is when Coca-Cola first launched Diet Coke; it took sales away from the flagship Coca-Cola product.

Let’s take a look at what else we know about cannibalization.

It’s expected.

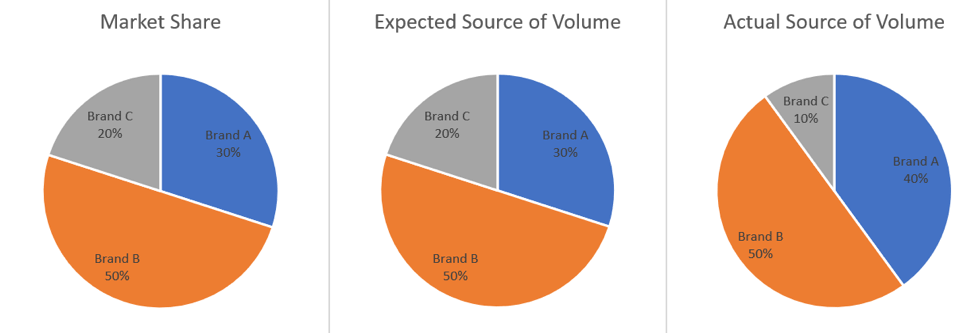

Theoretically, a new product should pull share from existing brands in the market proportional to the market share of those brands. According to research by Byron Sharp (2010), if Brand A has 30% market share and Brand A launches a new product into the same category, we can expect that about 30% of the sales volume of the new product will come from Brand A.

With consumers having access to more and more brands, some amount of cannibalization is inevitable. However, by identifying signals of excessive cannibalization, or when it exceeds a brand’s actual market share, earlier in the innovation process, brands can take certain measures to develop strategies to minimize impacts to the current portfolio. The earlier a company measures potential cannibalization, the earlier they develop innovation-risk-reducing strategies that mitigate cannibalization while maximizing incrementality.

It’s measurable.

Potential cannibalization can and should be measured prior to a product’s launch to understand the impact of bringing a product to market. By using a battery of survey questions combined with complementary behavioral data, we’re able to assess both cannibalization and conquest to understand where share for a new product will come from and how to strategically address each. This type of agile, iterative approach early on in the product innovation process can help companies understand the risks (cannibalization) and the reward (conquest) of launching a product.

It can be good.

The good news about the occurrence of cannibalization is that conquest normally accompanies it. Cannibalization can be a positive if customers switching to the new product or coming into the category outweigh lost sales from the existing portfolio. In our previous example, when Coca-Cola launched the Diet Coke product, it also took sales away from the competitor brands. Cannibalization can best be described as a necessary evil that must occur in order for conquest to happen.

In today’s crowded marketplaces, cannibalization is expected. However, a proactive, iterative approach to measure cannibalization throughout the product innovation process can help companies understand potential cannibalization risks and develop strategies to mitigate those risks. Keep an eye out for our next blog in this series where we’ll discuss strategies to maximize conquesting, or incrementality, when launching a new product.

In the meantime, if you’d like to take a deeper dive into the topic of agile, iterative research, take a look at our eBook below.

Written By

Learn how GutCheck’s Persona Connector solution leverages a combination of survey and big data to bring actionability to persona development.

Follow us on

Check Out Our Most Recent Blog Posts

When Vocation and Avocation Collide

At GutCheck, we have four brand pillars upon which we build our business. One of those is to 'lead...

Reflections on Season 1 of Gutsiest Brands

Understanding people is at the heart of market research. Sure, companies want to know what ideas...

Permission to Evolve with Miguel Garcia Castillo

(highlights from Episode #22 of the Gutsiest Brands podcast) Check out the latest lessons from our...

1-877-990-8111

[email protected]

© 2023 GutCheck is a registered trademark of Brainyak, Inc. All rights reserved.

© 2020 GutCheck is a registered trademark of Brainyak, Inc. All rights reserved.