Webinar Recap: Google’s Approach to Product Innovation

To avoid failure, UX researchers and marketers work hard in their respective fields to understand the marriage of product to consumer: that is, how products will be viewed and used by certain consumers. They tackle this challenge through personas, consumer segmentation, and uncovering customer preferences, habits, and desires. But sometimes these tools and techniques can’t anticipate risk because they don’t provide a full enough picture.

When companies broaden their horizons from just launching a product to landing it, then they enter a new space where the product truly adds value and makes an impact in the marketplace. Together with Google’s UX team, we maintain that this can be done by performing and sharing holistic research across internal silos to help understand the risks of innovation and find the niche of customers who will not only adopt but spread new ideas.

High-profile failures: what happened?

Google Glass was a phone people could wear on their faces, projecting the phone’s functionality and connectivity into the user’s field of view at all times. The consumer segment Google was going after were the people who were highly interested in technology and wanted to be part of the future. But when customers used the product, they didn’t understand the social impact they were having by wearing Glass on their faces. In social scenes, other people were uncomfortable with it, and the product ultimately failed to catch on.

In the CPG world, at the time that Coca-Cola launched Coca-Cola BlāK, 64% of Americans over the age of 18 drank coffee and half of all Americans drank soda daily. The natural conclusion had been to combine the two into one beverage. But apparently 0% of people actually wanted to drink coffee and soda together, which made the product a disaster.*

Even with the best of intentions, Google and Coca-Cola didn’t anticipate the risk factors involved with launching their respective products.

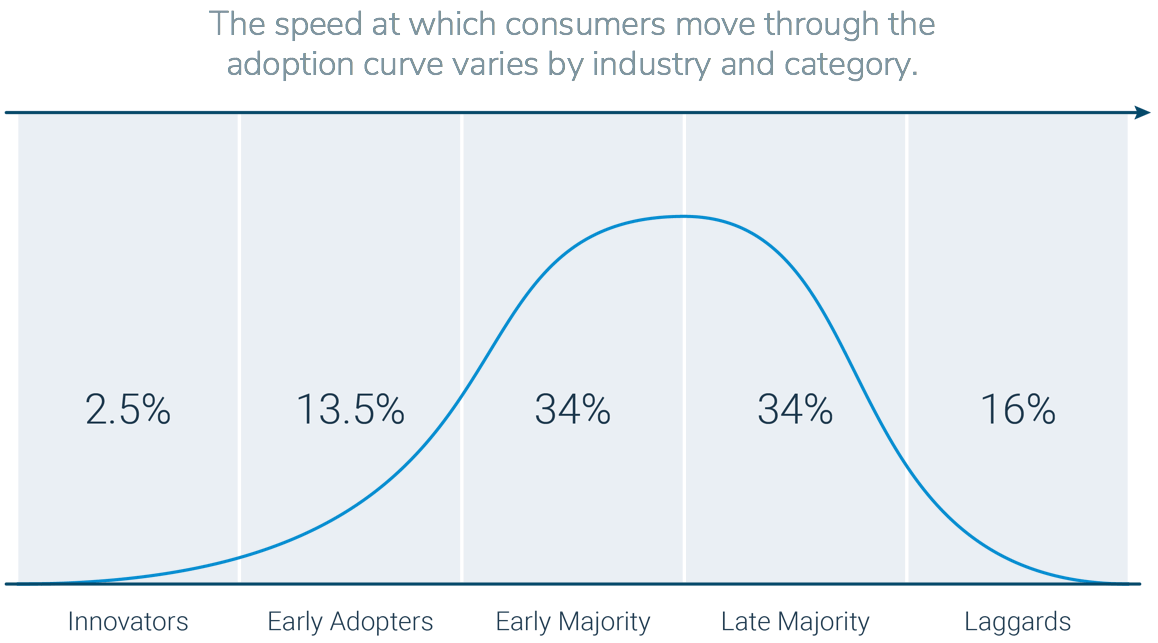

We can look at what happened by applying the Diffusion of Innovation Theory, which breaks up the market into a product adoption curve, as such:

Google Glass focused on the innovators (or the “explorers,” in their world) by touting the newness and novelty of Glass. But by focusing too much on the innovators, they didn’t discover how the early adopters would find value in or consider the product, and it turned out these groups were turned off by it. In Coca Cola’s case, the opposite was true: they only understood the mass market — the middle of the product adoption curve — and missed discovering if the early part of the market (the innovators and early adopters) would actually find appeal in the Coca-Cola BlāK product.

Each of the groups along the curve has to be treated as special and unique from each other. But to only understand one or two groups risks not understanding the rest of the market and how those groups may factor into the product launch.

That’s where deep, cooperative learning comes into play.

Integrating the science of human behavior with the art of marketing

There are a number of ways to define and plot out the consumer space.

Take, for example, Google’s fine-tuned approach to UX research. Google’s UX personas capture user context, patterns, and attitudes in the technology space. But another dimension they incorporate is the UX product persona, or how the tech product is used, experimented with, or regarded, and if and how it adds value to a user’s life. Combining user context with product personas “chunks up” consumer segments into smaller and smaller pieces to gain a more nuanced understanding of each one.

From a marketing perspective, using an audience-first approach helps build out consumer profiles with as much context and detail as possible to translate into the right messaging and marketing materials when it’s time to launch. That can mean pulling in UX research, using consumer segmentation, and plotting out the product adoption curve to build the richest profiles possible.

The more granular both UX and marketing can get, the better. But as each gets deeper and deeper into the details, they can end up with more and more subsets of unique consumer segments.

If all of this sounds complicated, that’s because it is. Identifying where segment adoption, UX, and marketing intersect uncovers the small, key consumer niches that will drive the most impact for your product. And the very act of finding these key niches breaks down internal silos between UX and marketing. Instead of applying dueling consumer models, both UX and marketing begin to see how each model is complementary to the other and can be used to better understand the whole consumer.

By embracing the complexity, you can thoroughly map out the consumer space and be thoughtful and intentional about which consumer segments to start with, since not every segment is important for launch. Bottom line: complexity upfront simplifies the launch process later.

A new, holistic approach to innovation

It’s important to realize that product innovation is not a single event. Instead, it’s a process predicated on continuous learning, iteration, and focus on the key niches that really matter.

If we all accept that innovation is valuable, then to reduce the risk that comes with innovation and be able to land a product rather than just launch it, you need to think holistically and across silos, combining the strengths of each silo to achieve success. You can do this by also accepting the following:

- Niche is the new normal. Start small (even really small, if you have to) with specific consumer understanding to grow big.

- We’re better together. Recognize the strengths of both UX and marketing data and build on ideas together.

- Iteration is key. Employ a continuous process of iterative research.

To learn more about how UX and marketing can learn from each other and work together in service to innovation, watch the full webinar.

*See full webinar recording for sources.

Written By

Learn how GutCheck’s Persona Connector solution leverages a combination of survey and big data to bring actionability to persona development.

Follow us on

Check Out Our Most Recent Blog Posts

When Vocation and Avocation Collide

At GutCheck, we have four brand pillars upon which we build our business. One of those is to 'lead...

Reflections on Season 1 of Gutsiest Brands

Understanding people is at the heart of market research. Sure, companies want to know what ideas...

Permission to Evolve with Miguel Garcia Castillo

(highlights from Episode #22 of the Gutsiest Brands podcast) Check out the latest lessons from our...

1-877-990-8111

[email protected]

© 2023 GutCheck is a registered trademark of Brainyak, Inc. All rights reserved.

© 2020 GutCheck is a registered trademark of Brainyak, Inc. All rights reserved.